Savings

Prudent savings strategies should fall under three categories; short, medium and long term.

Short Term

Build an emergency fund to safeguard against unexpected circumstances. Separately, plan and budget for holidays and other annual events.

Medium Term

Whether planning for your wedding or saving for a house deposit, a disciplined plan is key to achieving these objectives. Ensure that you avail of some level of reasonable deposit interest with your Bank, as opposed to your hard-earned monies earning virtually nothing in your deposit or current account. Consider other bank deposit vehicles such as Revolut, where more attractive deposit rates are generally available.

Long Term (5 years plus)

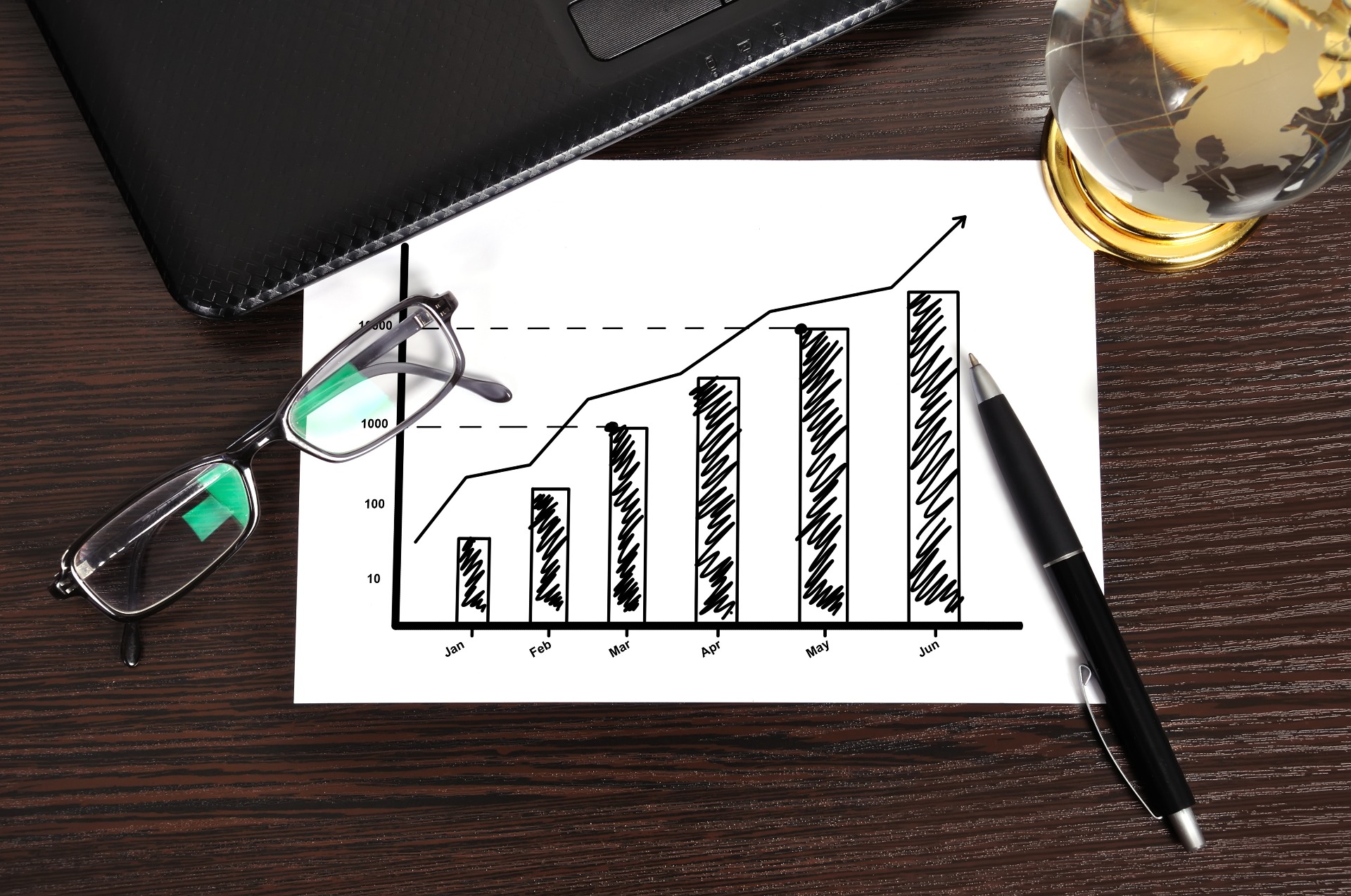

It may well be a Children's savings/education plan or just optimising one's disposable income, in any case, we can help you with a diverse range of savings solutions tailored to your specific needs. By starting a Regular Savings Plan, you can witness the growth of your savings over time. When you consistently set aside a portion of your income, your savings are invested in a range of investment funds depending on your risk profile. We can help you optimise your savings strategy, ensuring you can confidently reach your savings goals.

Start securing your child's future today to provide them with the best opportunities in life. By taking action early and beginning your savings journey now, you can maximize the financial support available to them. Through this planning, you have the opportunity to build a dedicated fund for your child.

Separately, for those parents or grandparents who can afford to, by assigning a plan to your child, you can leverage Gift Tax exemptions of €3,000 per annum from any individual (€6,000 from a married couple).